Beautiful Tips About How To Buy Rrsp In Canada

Deposit money into your rrsp savings account to earn interest, or buy a rrsp gic.

How to buy rrsp in canada. The funds must have been on deposit at least 90 days before you withdrew them, and a. You can withdraw up to $35,000 from your rrsp to buy your first home under the home buyers’ plan. To compute your remaining contribution room subtract the amount you've already.

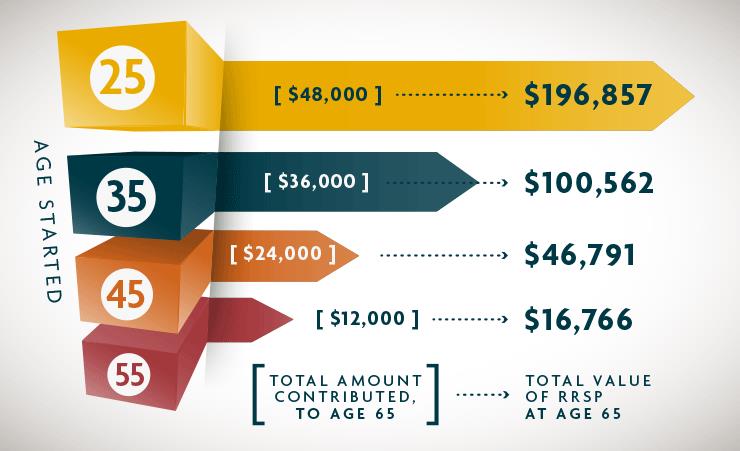

Use our handy calculator to crunch the numbers and estimate how rrsps make a difference!. Your home cannot have been owned for more. For the 2022 taxation year, your rrsp contribution limit is 18 percent of the income you reported on your tax return the previous year, up to a maximum of $29,210.

In 2021, the maximum annual rrsp contribution limit was. They decide to use the hbp for the down payment. A registered disability savings plan (rdsp) is a savings plan intended to help parents and others save for the long term financial security of a person who is eligible for the.

You set up a registered retirement savings plan through a financial institution such as a bank, credit union, trust or insurance company. Originally, you could borrow up to. They need to come up with a minimum down payment of 5%, which is $15,000.

You must buy or build your home before october 1st of the year following your hbp withdrawal. Your taxable income after your $10,000 rrsp contribution is: Rrsp home buyers’ plan (hbp) there are plans that are offered by the government that allow you to withdraw from your rrsp early without paying withdrawal tax.

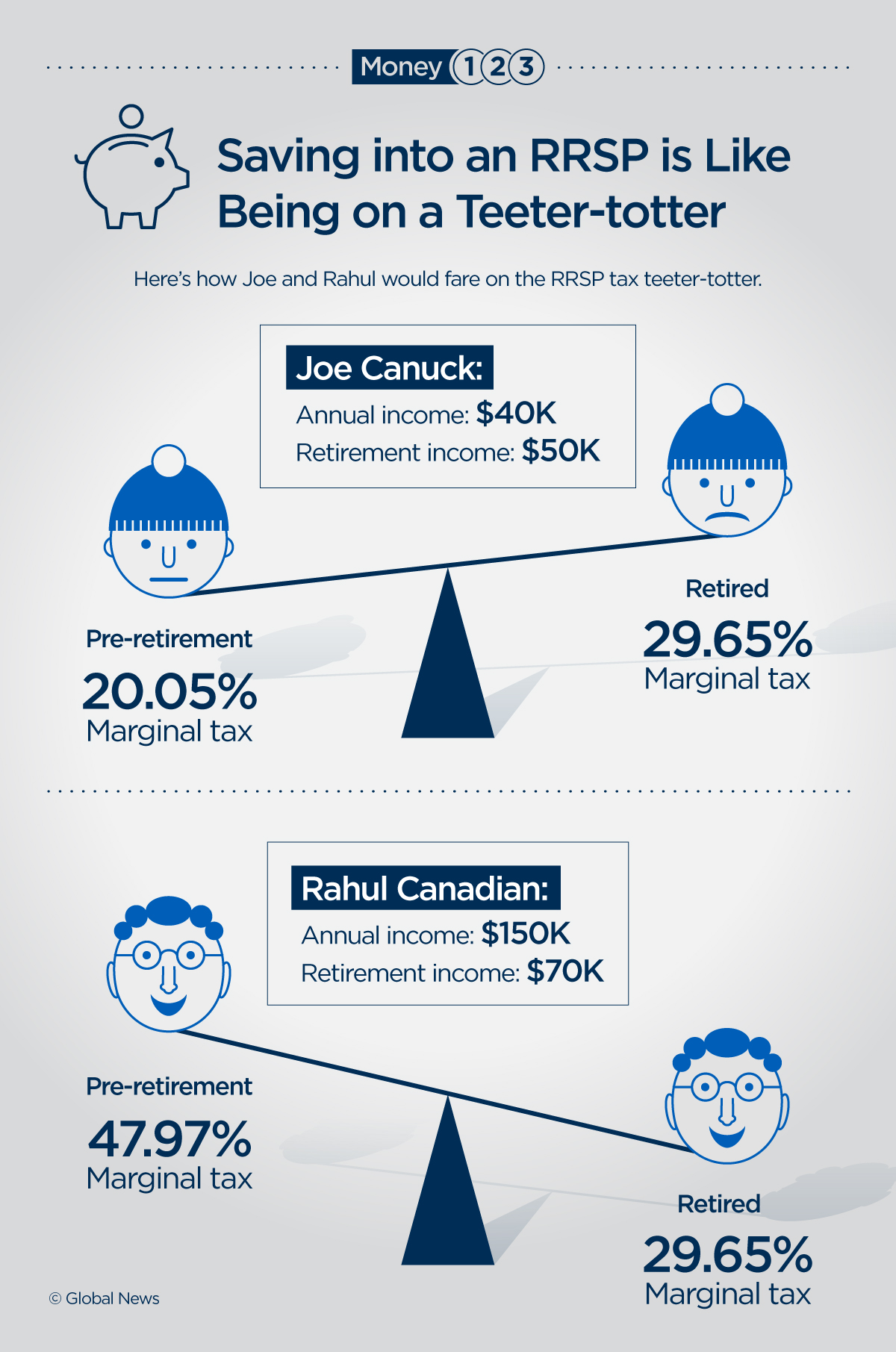

You must be a resident of canada. Rrsp contributions can help change your tax outcome. The withdrawal, however, is subject to withholding tax and the amount also needs to be.

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2021/10/25/im-saving-for-a-long-term-goal-should-i-use-an-rrsp-or-a-tfsa/in_your_corner_photo.jpg)