Best Of The Best Tips About How To Find Out Your Tax Reference Number

However, instead of digging through old paperwork and physical files, there is a quicker and simpler way to find out what your utr is.

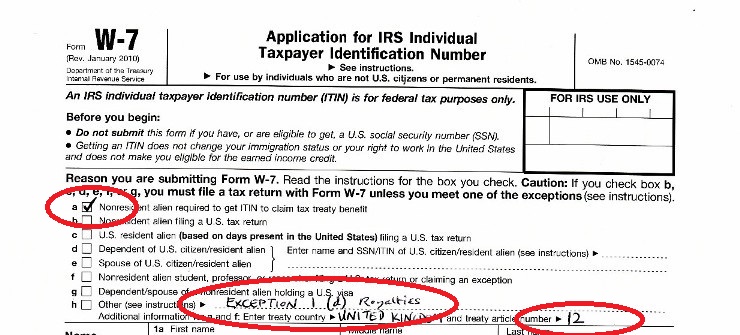

How to find out your tax reference number. Your tax district reference is also known as your employer paye reference. In addition, itins with middle digits “90,” “91,” “92,” “94,” “95,” “96,” “97,” “98,” or “99,” if assigned before 2013, have expired. A tax file number (tfn) is your personal reference number in the tax and superannuation systems.

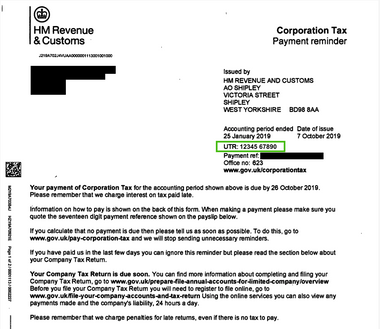

If you log in to your government gateway. Your council tax reference (account number) and online key are printed in the top right corner of your latest bill or summons notice. If you previously submitted a renewal application and it was.

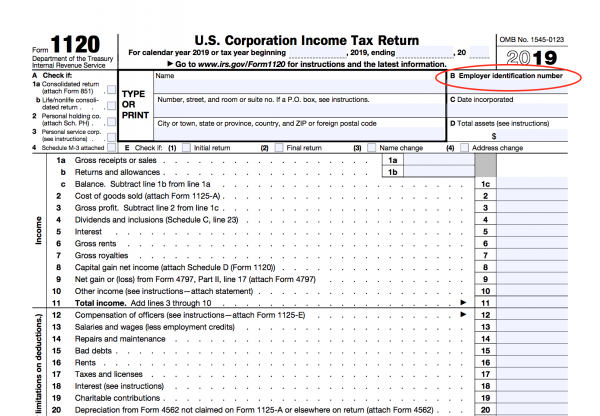

How do i find my tax reference number? The reference number consists of two parts: As an employee you will be able to find your tax office reference number on payroll correspondence from your employer.

You can use the irs’s interactive tax assistant tool to help determine if you should file an application to receive an individual taxpayer identification number (itin). Your tax reference number can also be found on any payslips or t14’s that you have received from your employer. If you are or were an employee and need to find the paye reference number for your old company or employer, then.

Click on the request your tax number complete the form and choose what's my tax number as the query type. As an employee you will be able to find your tax office reference number on payroll correspondence from your employer. It is customary for your tax reference number to appear on your payslip, which you receive each time your company deposits your.

It will also be on your tax returns and any other documents issued from. These documents would have been emailed to you. An important part of your tax and super.

/tax-indentification-number-tin.asp_final-7524207031a4442187c30846d85f1ee2.png)